This article first ran in Edtech Insiders.

Since the dizzying highs of 2021, the edtech sector has faced a stark reality check. The spigot of fast money from low interest rates and federal funds has largely dried up. Funding for startups that have not kept pace with their valuations has dimmed. At the same time, AI has unleashed a wave of company creation — and destruction. Traditional institutions from universities to public schools are reeling, although students, parents, and workers have never had so many opportunities at their disposal.

Amidst these contractions, the U.S. edtech funding environment appears to have stabilized. Even more promising: a new wave of startup creation and investments fueled by AI offers hope that a rebound is on the way.

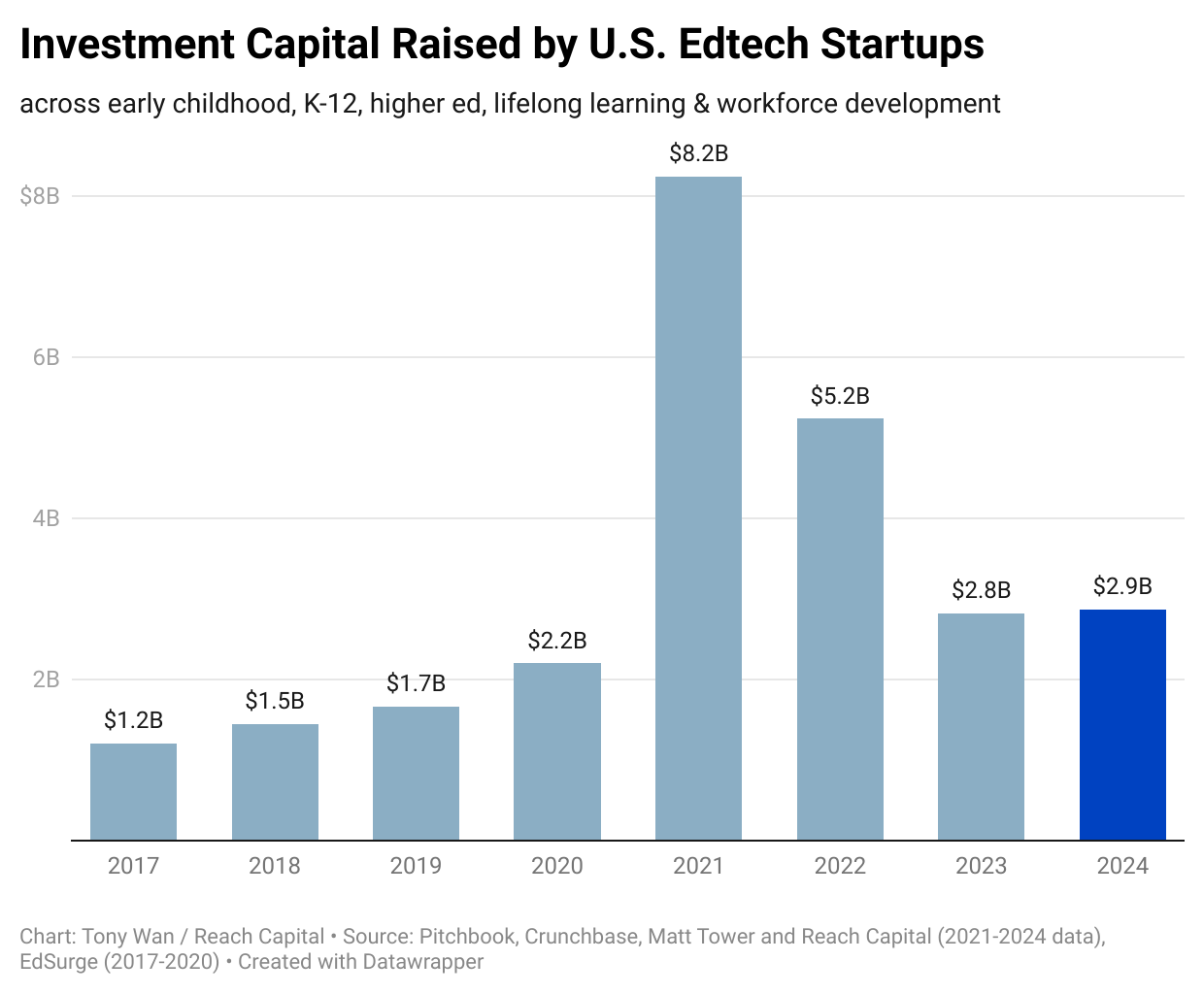

In 2024, U.S. edtech companies raised $2.9 billion, a modest improvement from 2023. More significantly, it ends two years of decline. This is based on my annual review of 241 deals from Pitchbook, Crunchbase, Matt Tower, and our own internal data, for tools focusing on teaching, learning, and economic opportunity across early childhood, K-12, higher ed, workforce, and lifelong learning.

Even before Generative AI, “edtech” has been expanding beyond its traditional confines of curriculum, instruction, and assessment. Between declining enrollment, staffing shortages and budget shortfalls, and the broadening needs of students and teachers, schools and colleges increasingly rely on external partners to expand their village of support. When I first started reporting on this space 13 years ago as the co-founder and managing editor of EdSurge, mental wellness, food, transportation, and teacher housing hardly registered on the map.

Today, many of these functions are getting much-needed upgrades, buoyed by powerful new technologies. The lines between edtech and adjacent sectors in workforce and health have also increasingly blurred, as training and learning are age- and sector-agnostic endeavors.

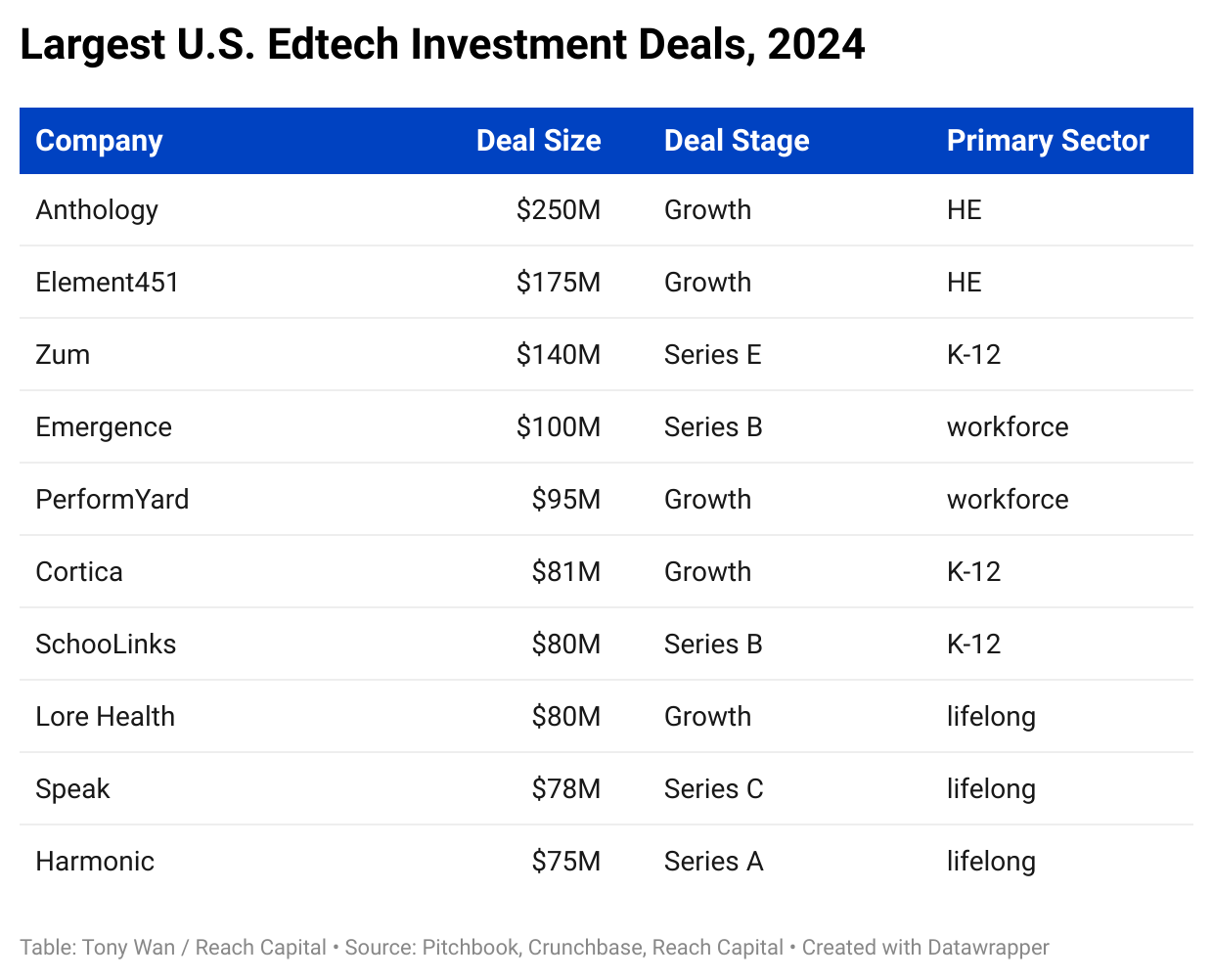

The biggest deals of 2024 address a wide range of problems. In higher ed, Anthology provides LMS, SIS and other data systems while Element451 helps improve enrollment, retention, and staffing. Zum is using AI to optimize K-12 transportation. Emergence bridges edtech and deeptech with multi-agent AI tools for knowledge workers. And the newest unicorn Speak is a new language learning tool focused on spoken conversation practice.

Tools for school-aged learners continue to represent well. SchooLinks’ $80 million Series B is a strong signal that college and career readiness programs remain very much in demand in K-12. In special needs, Cortica provides therapy services for autistic and neurodivergent children and Forta ($55 million) provides family-powered autism therapy.

These funding rounds prove there is still investor demand and market opportunity, but they don’t tell the whole story of where edtech is headed and how it must evolve. Since 2021, as capital markets reeled from sharp raises in interest rates and investor skittishness, many companies prioritized profitability and capital efficiency over growth to extend their runway and hold out for better times. Yet slower growth has also meant a lower likelihood of hitting the benchmarks needed to raise follow-on rounds; thus the many extensions, flat, and down rounds we saw in 2024. For companies that raised at the peak of the market, it’s been a challenging year.

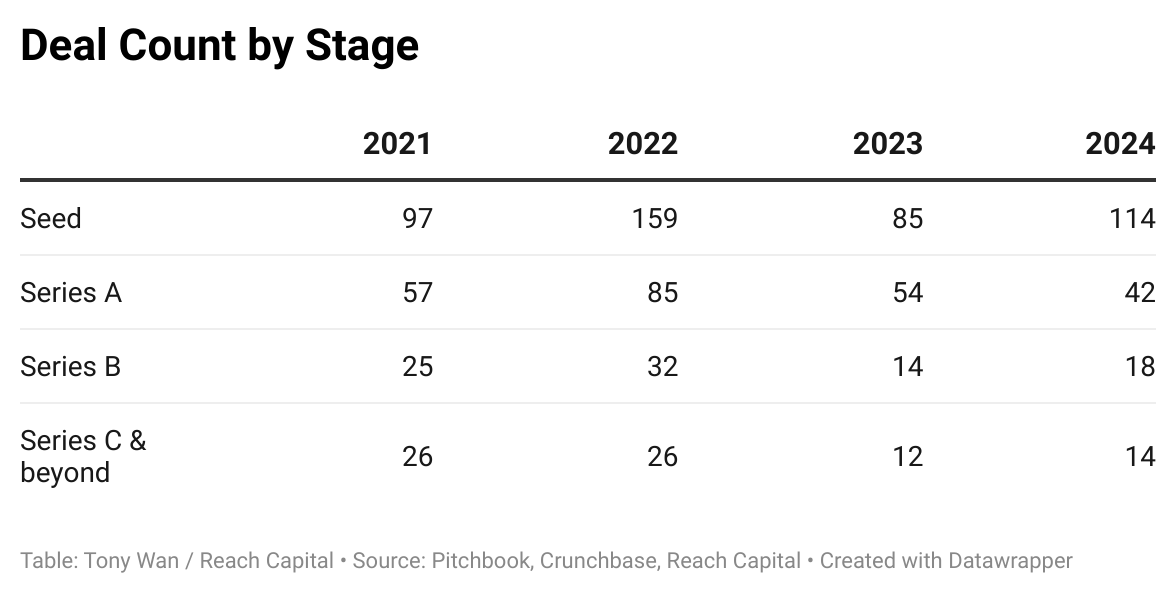

Although late-stage and mega rounds exceeding eight figures remain down, this year saw a sizable bump in the number of seed deals. Continued advancements in AI models and agents is driving a surge of new tools. There has also been a blurring of edtech and deep-tech platforms like Harmonic, which is building math reasoning tools that may surpass human capabilities and shape how we learn and teach math and sciences.

In 2025 it’s reasonable to expect even more action at the seed stage, because AI has made it so much easier to build and scale quality software at a fraction of the cost of past products. The first prototype of MagicSchool, perhaps the fastest growing edtech tool in K-12, was built on Replit. (Disclosure: both are Reach portfolio companies.) Expect others to follow, from seasoned founders, educators, and students alike.

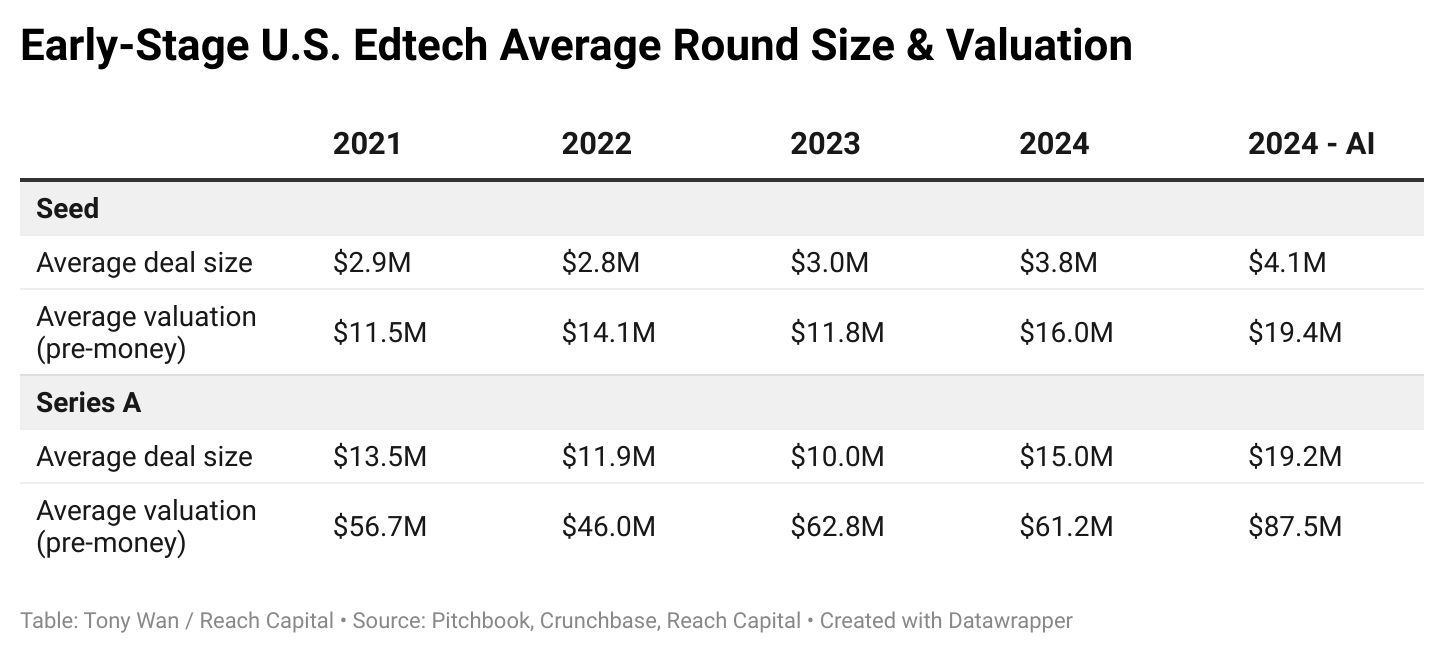

Moreover, at the Seed and Series A stages, average deal sizes and valuations have actually increased since the heyday of 2021, with AI-native startups further driving up the numbers. (But please, don’t slap AI in your deck unless you really mean it.)

The mean Seed deal in 2024 was almost $4 million — and beyond for AI startups. These numbers were pushed by outliers like Buddy.ai, an AI English learning platform which raised $9 million, and Outsmart Education, the college alternative led by former Duolingo executives that raised $14 million. The average Series A deal shot past $15 million, though this is skewed by Harmonic’s $75 million raise.

The use cases for edtech have never been more diffuse. (Just check out Edtech Insiders’ Generative AI market map.) The deluge of new tools may feel bewildering to parents, educators, and funders trying to sort out what’s best, but for the industry overall, this is a good problem to have. What is undeniable is the human desire to find and build ways to improve how we teach, learn and live.

Edtech Everywhere All at Once

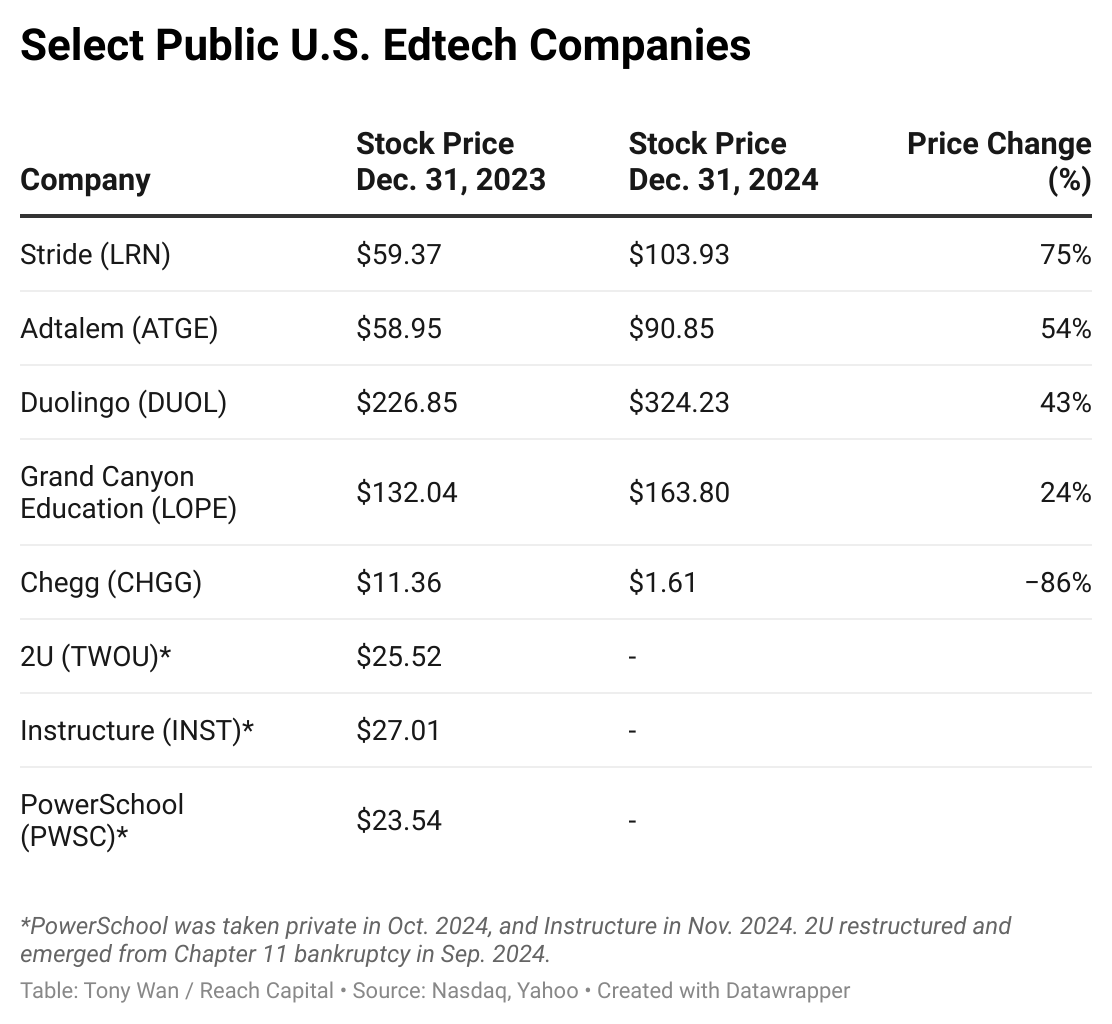

In the public markets, 2024 was a mixed bag. In higher ed, two former darlings have cratered: 2U filed for bankruptcy, and Chegg’s market cap plummeted as it lost users to ChatGPT and other AI study aids. But older names like Adtalem and Grand Canyon Education, which operate vocational-oriented higher-ed programs, grew steadily. It’s a reminder that post-secondary education can be stubbornly durable, even as some of its traditional institutions face dire financial challenges.

A couple of other brand names were taken private — PowerSchool by Bain Capital for $5.6 billion, and Instructure by KKR for $4.8 billion — and are poised for change as the new owners have announced an aggressive approach to expanding their platforms.

Those that have embraced the shifting winds have seen explosive growth. The biggest name is Duolingo, whose stock gains doubled the S&P 500’s this year. The company continues to invest heavily in AI to generate data for its lessons and real-time conversation practice as it also expands into new areas in music and math.

Also performing well, though largely under the radar, is Stride, the virtual schooling provider formerly known as K12. Driven by record enrollments for its general ed and career learning programs, its stock price recently reached a record high. In recent years, the company has expanded its portfolio of programs and technology partners in response to the changing needs of learners.

“Markets and situations move quickly and can change or pivot on a dime,” Stride CEO James Rhyu recently said in an interview. “The pandemic did more to sell school choice in America than any other force or factor in history, and we positioned ourselves accordingly to serve more families desiring different learning modalities for their kids.”

The evolving K-12 market will necessitate new business models as the “forking” of public education dollars continues. Seventeen states serving 22 million students now have education savings accounts (ESA) programs in place, potentially creating a rich market for direct-to-consumer products. Companies selling to schools may do well to add a consumer orientation, as parents have more say in directing where funds go.

In districts facing steep budget cuts, school leaders are starting to pilot outcomes-based contracts, in which the total value of the contract is based on meeting pre-set outcomes. These are tricky to implement, especially given Laurence Holt’s finding that just 5 percent of students in edtech research studies used the tools at the minimum level prescribed. But should these scale, it will be consequential.

For adults, edtech has become incredibly diverse, featuring verticalized learning solutions for different professions and hobbies. Labor-strained industries have their own specialized training programs, such as Stepful for health care (a Reach portfolio company) and RockEd for the automotive industry. AI copilots are emerging to assist workers with workflows, training and research unique to every sector.

Edtech is also global. It’s beyond the scope of this analysis, but it’s worth mentioning that the mega rounds also went to India-based PhysicsWallah ($210M Series B at $2.8B valuation) and Eruditus ($150M Series F). U.S.-based companies are seeing a greater percentage of their usage from abroad — and vice versa.

In the Chinese Zodiac, 2025 marks the Year of the Snake, symbolized by the shedding of the skin as part of transformation and growth. Between a new administration, advancing technologies, challenges to traditional institutions, and new market opportunities, much change is afoot. Just as cloud technology unleashed new creation and distribution powers, and with it new categories of learning tools, so too will AI. My wish for the year is that we continue to expand our definition of what constitutes “edtech.”