As the late composer Antonio Carlos Jobim once said, “Brazil is not for beginners.”

The economic powerhouse of Latin America, Brazil’s unique demographics and educational systems, combined with a burgeoning tech and startup scene, present unique market dynamics and opportunities that warrant special attention.

In April 2023, we hosted events in São Paulo and Rio de Janeiro in partnership with our friends at Monashees, Gera Capital and Endeavor. We met with founders, students, teachers, parents and operators at educational institutions and large corporations. We were delightedly surprised at the diversity of people who attended our events, and their enthusiasm and entrepreneurial energy for Brazilian edtech.

Photos from Reach Capital’s Brazil Trek

Photos from Reach Capital’s Brazil Trek

The result of our research is this Primer on the Brazil Edtech Market, which looks at the demographic, technological and labor trends behind its education and workforce systems. In short, a growing tech-fueled economy is quickly outpacing what its educational system can support, which in turn creates enormous market opportunities for edtech startups.

The first part of this blog series shared our investment theses for the broader Latin American edtech ecosystem. In this piece, we look at where there are promising opportunities in Brazil for new, transformational edtech companies to emerge.

Background

Brazil boasts a large educational system serving 47 million students in K-12 and 9 million students in higher education. Yet it is rife with inequality and inefficiencies, and student achievement is very poor by global standards, ranking near the bottom on most PISA measures in 2018.

It is also the largest economy in Latin America, accounting for one-third of the region’s GDP, with a vibrant startup ecosystem that receives the largest share of venture capital (40% to 50%) in the region. Still, more than 3 in 4 employers report difficulties in hiring qualified professionals, particularly with digital skills. (To learn more about Brazil’s macroeconomic trends, Atlantico’s Digital Transformation Report is a must-read.)

Unlike Spanish-speaking Latin America, Brazil is home to large, incumbent education companies that generate billions in revenue in K-12 (content publishers like Arco Educacao and large private school networks like Grupo Salta) and higher education (online private universities like Cogna). Their growth is evidence of a growing market for educational digital solutions — and they also set the bar of what it will take to win in this market, in terms of product and distribution.

The market share of these players is significant as they dominate the share of their customer’s wallets. Sistemas de Ensino (all-in-one content providers for K-12 schools), for example, can make 150 to 250 dollars per student, given that they provide core curriculum and additional services to run schools. Compare that with most K-12 edtech startups in Brazil, which make between 10 and 30 dollars per student providing point solutions to very specific problems. Consequently, Sistemas can afford a strong sales force highly trusted by schools, which is hard to replicate for new entrants, so startups must partner or circumvent them.

Similarly, higher education students are already spending a significant amount of their disposable income on tuition, leaving little room for startups that might look to monetize other aspects of learning.

Edtech Tailwinds in Brazil

Having said that, we are seeing some strong tailwinds that create opportunities for startups to innovate in the following sectors:

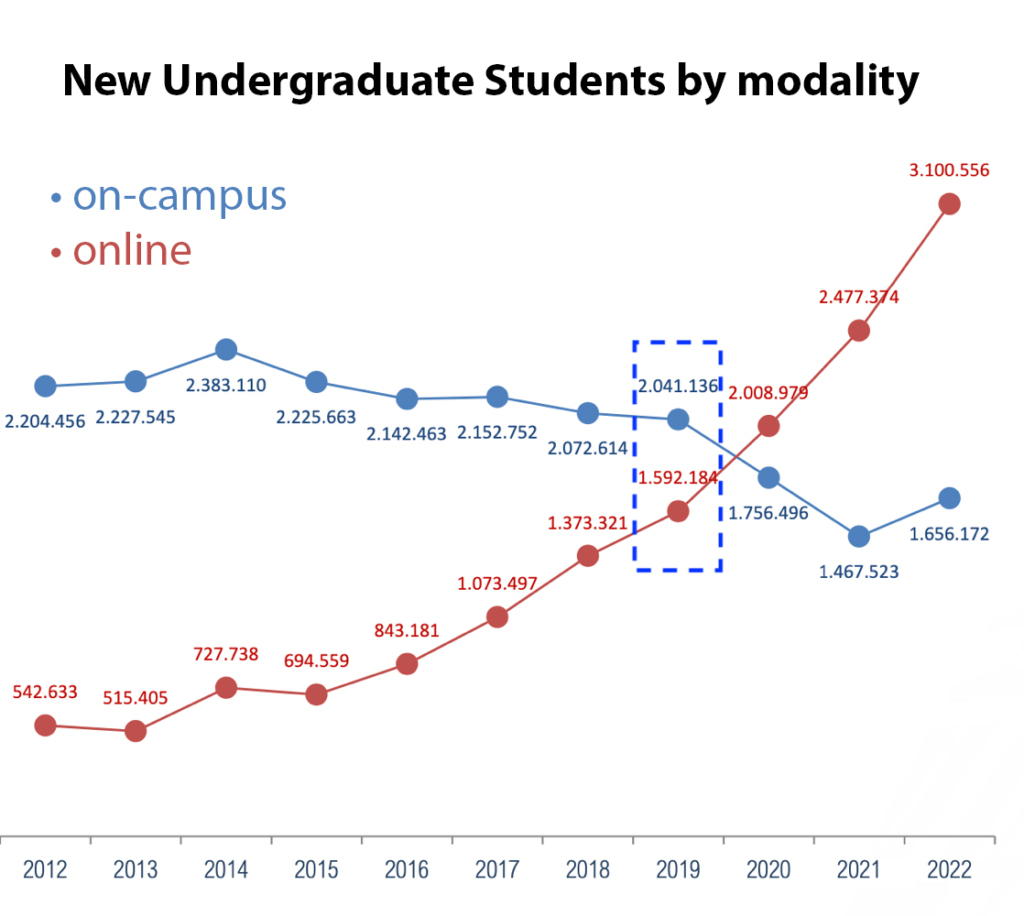

Growing adoption of online K-12 and higher education: The number of schools using educational digital platforms and the number of new higher education students signing up for distance learning continues to rise. At the same time, these markets are becoming increasingly commoditized and incumbents are struggling to differentiate between themselves beyond pricing.

Source: INEP, 2022

Students aren’t satisfied by incumbent universities, which are in a difficult financial situation. Private higher education students in Brazil have relied heavily on government-backed student loans (FIES) for tuition. Unfortunately, the number of students accessing this funding decreased from 731,000 in 2014 to 85,000 in 2019 as government funding declined amid economic challenges during this time. Meanwhile, the hard shift from on-campus to online education has adversely affected incumbent providers’ topline revenue. Online tuition is 50-75% cheaper than on-campus, and their fixed cost structure leaves them in an increasingly fragile financial position, including heavy debt burdens.

At the same time, universities have not been keeping pace with the fast shift to online learning. For instance, three of the largest Brazilian private universities have poor to average ratings according to Reclame Aqui, a consumer review website; those offering more distance learning options have lower ratings. In this situation, incumbents are vulnerable to new disruptive players.

AI lowers operational costs that once favored incumbents. Creating engaging, world-class content that meets curriculum requirements used to require a huge investment upfront. With Generative AI, that cost is being dramatically reduced. AI is also being used to reduce distribution costs related to content marketing. Companies are automating SEO and social media campaigns at scale, which were unthinkable just a few years ago.

Market Opportunities

Given those tailwinds, we are seeing the following market opportunities in Brazil:

Continued Digital Transformation of Schools: While Brazil has some very large school networks like Grupo Salta, more than 90% of schools are independent and run as small businesses on very thin margins. As demonstrated by the rapid growth of Isaac (a financial management solution for private schools), schools need solutions beyond content to run and manage their businesses more effectively. These needs extend beyond cash flow management and include a variety of tasks like enrollment and procurement that eat up valuable time and resources from private school owners and administrators.

Demand for Online, Regulated Higher-ed Alternatives: Brazilians have adopted online higher education at an unprecedented rate. The percentage of new sign ups attending online classes grew from 21.6% in 2013 to a staggering 60% in 2020. Yet many are unsatisfied with distance learning programs. Combined with the cost efficiency and productivity gains powered by Generative AI, there is an enormous opportunity to build a “challenger university.”

In this context, we are also seeing the surge of the regulated apprenticeship model given recent regulation changes (“Jovem Aprendiz”) that allow the entry of for-profit companies into the apprenticeship market. This allows startups to tap into dollars that Brazilian large companies are already allocating by law for hiring and training youth. Brazil currently has around 500,000 apprentices, and this number could reach 1 million if all companies complied with regulations.

Verticalized Edtech: My colleague Esteban Sosnik recently wrote about the Rise of Vertical Edtech and Brazil’s workforce markets are a great example of this trend. A number of tech-enabled education models are focusing on industries with increasing labor shortages, such as agriculture, or sectors with complex labor supply dynamics, such as restaurant and hospitality. A verticalized focus allows startups to upskill talent in those sectors and untap large markets in ways that extend their customers’ lifetime value through additional services such as recruiting, SaaS, and financing.

Healthcare is a great example. In Brazil, medicine is the top profession when it comes to employability and earning potential (entry salary is 1.5X average salary and 4X minimum wage). Yet demand for physicians is not well-served by existing education institutions. Brazil has 2.4 physicians per 1,000 inhabitants, lower than Argentina (3.9), Mexico (2.6) and the OECD average (3.5). Digital-first players such as Sanar and Medway are developing products that cater to healthcare professionals throughout their entire careers, from test prep, undergrad, residency, and specialty courses to graduate and postgraduate degrees. We believe there is a large opportunity for more startups in this vertical.

K-12 Consumer: In Asia, parents play a huge role in edtech spending. Most unicorns in China and India, for example, have been in consumer-oriented educational services and content for afterschool reinforcement. In Brazil, we are beginning to see early signs. For instance, Kumon has 300,000 students in Brazil charging $40 to $60 per month and continues to expand, while Descomplica, MeSalva and other SAT prep programs are growing with public school students making up over 70% of their customers.

If K-12 academic support is affordable and focused on core subjects, parents will be more willing to invest in it. We expect that as Brazil’s middle class grows, it will fuel demand for services like tutoring and English language learning.

Reach Out!

If you are building products and services that are narrowing gaps in access to education and economic opportunity in Brazil and Latin America, let’s talk!

Thank you to Esteban Sosnik and Rangel Barbosa for reviewing and contributing to this post. And especially to Amaral Medeiros, previously an edtech entrepreneur and operator, whose research has helped our understanding of the Brazilian market and has informed our investment theses for Edtech and Future of Work in Brazil.