Edtech Go-to-Market Insights: How to Balance TAM and Focus

We hear from entrepreneurs that they commonly get feedback from investors who love their product but are hesitant to move forward because (1) their target market is too small or (2) that they are not focused enough.

Both TAM and focus are super important aspects of the business and require some proof of evidence. How do you address a large TAM while remaining focused on your early customers in the beginning stages of your startup?

We talked to Armando Mann, who previously worked at Google, Dropbox, RelateIQ and Salesforce to get his views on the topic. Armando has built sales and customer success teams from the ground up (even at his own edtech startup back in 1999) and has advised countless startups. He enlightened a group of Reach Capital entrepreneurs several years ago on this very topic, so we thought we would share a summary of his talk for the wider edtech ecosystem.

Esteban: Hi Armando, thanks a ton for making time and for coming to our Founders’ Day a few months ago. What is your general framework to think about TAM vs focus?

Armando: As an early stage edtech entrepreneur, you have (1) a big vision on how you will change education, (2) your product, which in many cases can have a pretty broad use case/customer type application and your (3) go-to-market strategy which is where the rubber meets the road and where you need to get super focused.

How do you think about TAM?

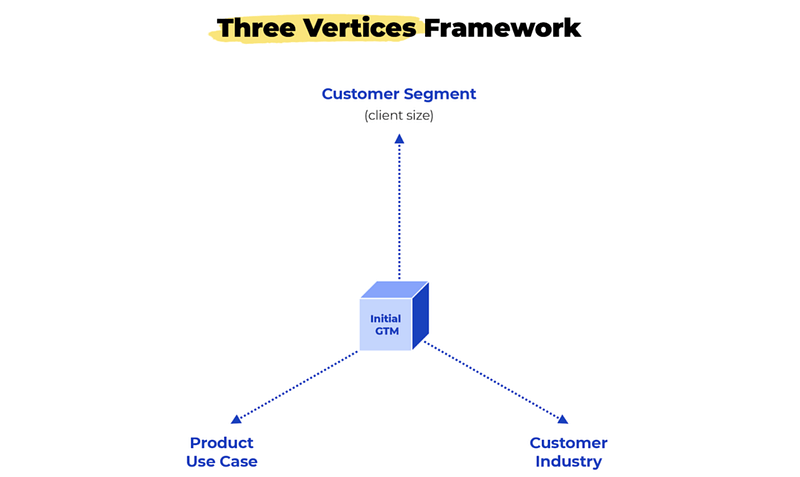

It’s up to the entrepreneur to define their market in a way that works for them. Ultimately you want to become the default solution for the problem you are trying to solve. But, you need to go after it in a cost-effective way so that the expansion plan is realistic. To do that I talk about expanding across three vertices.

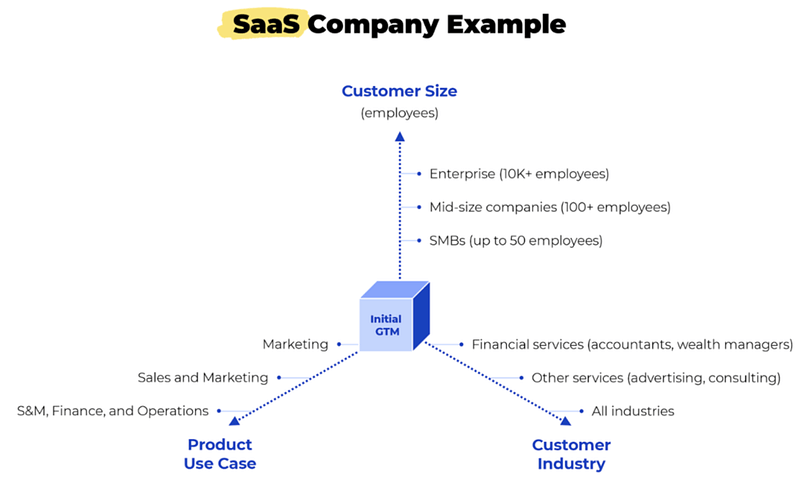

You should define your vertices based on your particular business. In my past experience (in SaaS) one framework that worked for me was the one pictured below. On one end you have the different Customer Segments or company sizes you can go after. On the other vertex, you have the industries or verticals you are going after. And on the third one the product use cases.

Here is an example of a company that might start as a marketing solution for SMBs in the financial services industry but have a vision to become a sales+marketing+finance solution for companies of all sizes and across industries

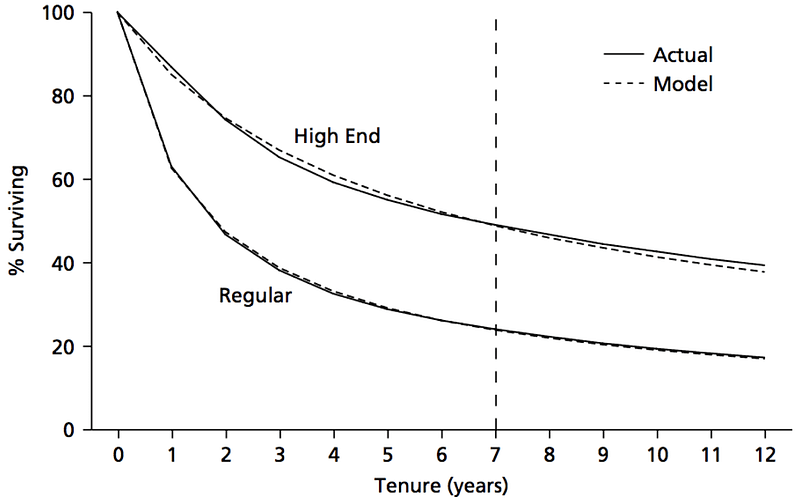

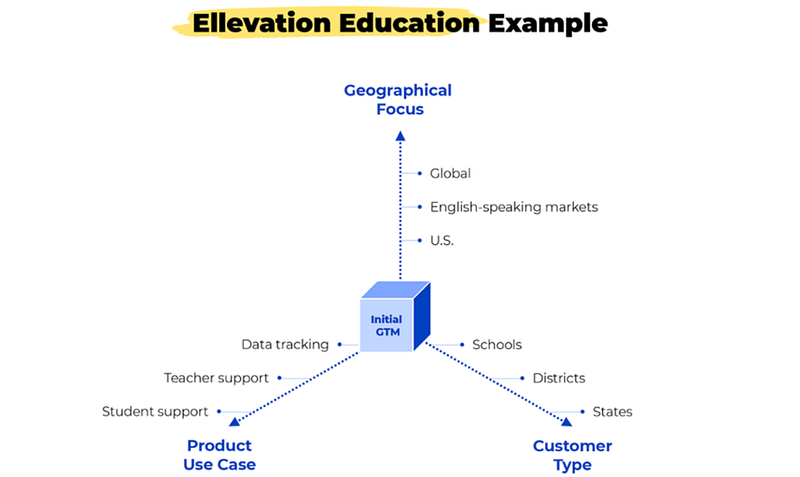

Let’s pick an example in edtech. Let’s say Ellevation Education, which is a company that serves English Language Learners (ELL) in U.S. schools.

Sure, in this example, theoretically the company can have a vertex for growth by serving ELLs in other geographies while a second could be another use case, such as serving not only school admins but also teachers and students. And yet a third could be going from a school product, to one based on district needs to a state product. How you define your vertices is dependent on your company and vision.

So how do you think about growing across them?

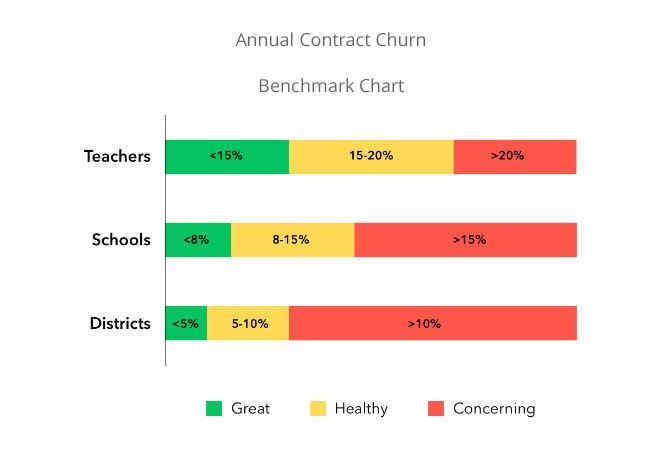

You have to start where you are really strong and have a competitive advantage. For example, most startups don’t have the infrastructure to attend to a large enterprise client from the get-go (say a large school district) so you start with smaller customers (ie) individual schools) and grow from there. The same can be applied to different use cases. You might start with an authoring tool like Nearpod (a platform that allows teachers to create interactive K-12 lesson plans directly to individual student devices) but eventually start realizing you can also offer content to your customers to use on your tool (hence they launched a content marketplace and eventually acquired Flocabulary). Now you are in two markets. And then you can go deeper into content and start tapping different content segments/categories.

The whole idea is that:

- you are very focused and aware of who should be your initial customer set, and

- you grow across these vertices organically and intentionally.

What are the benefits of doing this intentionally (arguably letting go of the other leads) as opposed to more opportunistically, for example, based on your inbounds?

The benefit is that when you conquer certain segments, your cost of sales starts decreasing rapidly. If you are targeting a CRM for startups as an example (like we did at RelateIQ) and 9 out of 10 YC companies are using you, then you essentially became the default for your market segment. At this point, customers are referencing each other, you grow organically and your CAC goes way down. You are now ready to move to your next customer type. The other benefit is that you can grow your product organically, as the needs of your new customers are likely not going to be dramatically different than your previous one, so you don’t need to reinvent your product as you grow across industries or customer types.

How does this impact your GTM then?

This strategy is everything you do in GTM! Your initial “cubic” focus should lead to how you communicate your value proposition to the world. You can’t talk about solving everything for everyone. All your communications have to be focused on your initial cube (and eventually incorporate the ones you grow into) — from the website, your tweets, the white papers you highlight, to the sales team that you hire to do inbound and outbound in that segment. As a customer, you want to feel that when I look at your materials and talk to your reps the product is built “for me”.

How can you inspire customers and sell them on the potential of your tech if you just talk about today’s product features?

This might be important for larger accounts. On these types of customers you can combine being inspirational (sometimes that could involve including the CEO or Head of Product or CTO to your sales meetings) but have the Head of Sales talk about the exact talking points you know will close the sale on the product you have today and the problem the customer has now.

How should you think about organizing the GTM team around this strategy?

I like to think about it this way. Until you have built a repeatable sales process in your initial “cube,” your founder should be the one selling with the sales team supporting her/him. Once sales in this category are repeatable and you are ready to expand via the other vertices, then the Head of Sales takes the lead in your initial cube and the founder goes back to finding new product-market fit in a new expanded category (across any of the three vertices). In this way your early adopters are always converted by the founder. You might have a small SWAT team that supports the founder in this customer discovery phase, but it works quite independently of the rest of the sales organization (meaning you don’t interfere with their repeatable process that took so much work to build).

How can you tell when it’s time to move beyond your initial “cube”?

You should stay in the first cube until you demonstrate a predictable and repeatable sales process in that market. You should be able to have a high close rate once you are in front of your ideal customer, and you should start having inbound leads and referrals. Then you can start exploring the next segment without risk of alienating your initial target audience. You know it’s time to expand when the cost of sales starts to rise.

Let me expand on this. Initially, your cost of sales should decrease as you have more referenced customers, and a higher percentage of inbound leads and referrals. But eventually, once you build up enough penetration, the cost of sales will start increasing again. That is probably a good sign that you need to expand your market either by going upmarket, to more functions within the client, or to adjacent verticals.

How should a company pick its initial “cube” to focus?

The great news is that it doesn’t matter! If you have several potential “first segments” where you can win, and you can expand thoughtfully from that initial segment, it doesn’t matter which one you pick. What matters most is execution behind it and knowing how to communicate to your team and investors how you will first become the default solution within your cube and thereafter expand across the vertices.

Any other commentary on the importance of focus on GTM strategy?

I think another important consideration is making sure you are true to yourself and only closing contracts that are in your area of focus. If you are building for and selling to K-12 schools but you get tempted and close a large corporate customer, your customer support will be a mess because they are not using the product as intended, the product feedback will be useless, and they won’t care about your new features. Be careful to close the customers that truly fit your three focus areas!

Thanks Armando so much for your amazing insights!