How Much Churn Can We Tolerate?

Dear Guido,

My company just wrapped up our second year of school and district contracts. We also sell directly to teachers. We feel good about the number of contracts we added this past year, but naturally we also lost some customers. For an edtech company to be successful, how much churn can we tolerate?

— Churn Concerned

Dear Churn Concerned,

Great question. In my experience, the best founders and the savviest investors will look at contract churn as a key indicator to determine the health of a business.¹ New sales matter, but churn among your existing paid customers matters even more!²

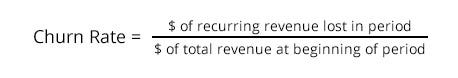

My first piece of advice is to define exactly how you want to measure churn and align everyone in the company around on the same metric.

At Nearpod, we use the following definition of churn:

However, defining churn for your business can be more complex than it appears. Check out Tomasz Tunguz’s post “Why Everything I Thought I Knew About Churn Is Wrong” to learn about best practices for measurement.

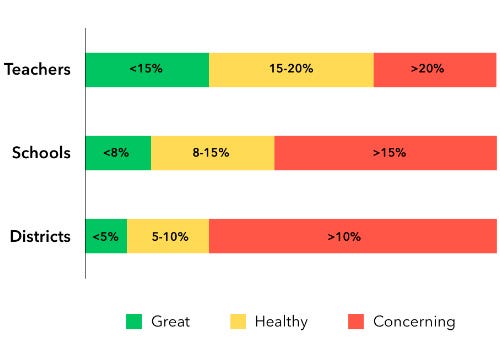

As far as how much churn you can tolerate, I should start by saying that not all churn is created equal. School, district, and single teacher churn should be analyzed as separate cohorts.³

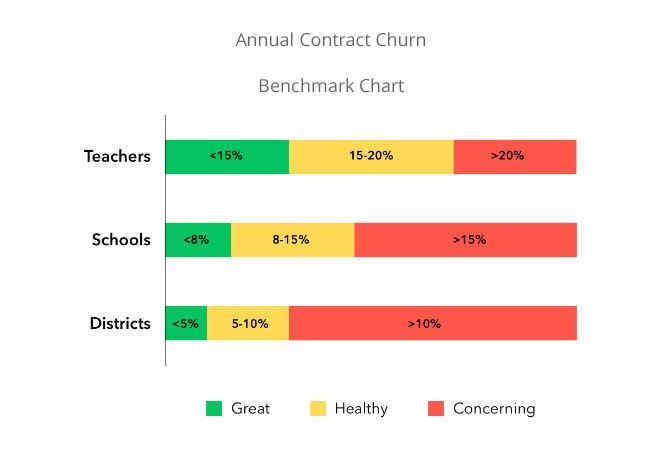

Here is a rough diagnostic based on my experience with Nearpod and from talking with edtech companies in other verticals:

Annual Contract Churn (Benchmark Chart)

Teachers

If selling to schools and districts is the main goal of your monetization strategy, then I would tolerate a higher teacher churn as long as you feel that the product is resonating well with teachers overall. At Nearpod, our paid teacher licenses have always churned at a higher rate than our school and district contracts, and I’ve heard similar stories from several fellow edtech founders.

Teachers typically churn at a higher rate than schools and districts for a variety of reasons:

- They find a free alternative to your product. (Teachers free products.)

- They change jobs and your product may not be as relevant in their new role.

- They do not engage enough with the product after they paid for it.

- They can no longer afford the product, perhaps because they moved to a new school or district with fewer resources.

If there are some teachers leaving your product because they can’t pay (and not because they are dissatisfied with your product), don’t worry — you can still monetize at the school and district level.

In terms of numbers, 15–20% annual churn among your paying teachers seems acceptable based on my experience. In general, individual consumers are more price sensitive than institutional buyers, and teachers are perhaps even more price sensitive than an average individual. With limited resources, low salaries, and many out-of-pocket costs, teachers often do not have the discretionary budgets to pay for tools unless they become absolutely essential in their day-to-day work.

If your teacher churn is over 20%, that can be a reason for concern, and you should dig deeper to understand what’s really going on. Here are a few strategies that we’ve tried that can help mitigate teacher churn:

- Start by understanding why there is churn. Diagnose your churn by asking teachers why they are unsubscribing before they leave your product. You can even call a few of them to get more detailed information on what was and was not working… you’d be surprised just how many of them are willing to help!

- Make renewals easier. Try asking for credit card information upfront or offering incentives for early renewal or longer subscriptions (e.g. yearly instead of monthly).

- Nurture relationships with dedicated teachers, even if they can’t afford to pay. It’s important to remember that not all value comes in the form of revenue. There are plenty of ways that teachers can provide value to your company, you just have to help them untap it. For example, you can give your product for free to teachers who are willing to promote as ambassadors, leading professional development workshops, presenting at conferences, providing testimonial to key decision makers, etc.

And if churn is unavoidable, you can always try to convert a churned teacher into a marketing lead by extending their subscription in exchange for an introduction to a decision-maker like a principal. This strategy is best for users who were active on your platform but might not be able to pay out-of-pocket anymore.

Schools

Schools often behave like small and medium sized businesses (SMBs). They will opt for smaller contracts, which means that normally you can service them by investing fewer resources than a larger district contract. For efficiency purposes, you may skip customer touch points like in-person onboarding, on-site training, or monthly check-in calls. In my opinion, these factors make annual contract churn up to 15% acceptable at the school level.

However, be sure not to classify small school contracts as less important. Many times, those small contracts have big upsell potential (e.g. a “model school” in a large district). You will want to prioritize such contracts as “high potential” deals, and make sure that your team invests more resources to service, renew, and expand those contracts over time.

Districts

School districts often behave like enterprise customers. The sales cycle usually takes at least three months, and it can take up to a year before you make a sale. Losing a district contract may cost you years to win back, if ever. Plus, remember that there are only ~15,000 school districts in the U.S., so your pool of potential customers is finite. Every district matters!

Because of this, every district account lost is a huge red flag. You and everyone on your team must understand that churn in this market segment is a major problem. In my experience, annual churn for district accounts should ideally be below 5%, and certainly below 10%.

In sum, make sure you segment your customers when analyzing churn, and set your relative churn targets at a level appropriate to the potential value of the relationship. Churn is an inevitable aspect of an edtech business, but recognizing high churn in a particular area relative to industry norms can help you zero in on potential problems with your product, positioning, or distribution strategy.

In a future post we will discuss some winning strategies for customer success and the need to focus on “Net Revenue Retention” once your contract churn is under control.

¹ (From Esteban) I agree — churn is definitely a key metric for me as an investor. In this post, Guido focuses on churn among paying customers, but as an investor, I also care about the churn among users of your free product. What percent of your downloaded user base is actually using your app on a frequent basis? And how is that number changing over time? Retention and engagement are essential to our decision about whether to invest, as we want to know that your product is loved and essential to your users. Further, we want to know that you are improving the product over time (which should drive more retention and engagement.)

²Unconvinced about the importance of churn? Read Tunguz’s “Why Negative Churn Is Such A Powerful Growth Mechanism” .

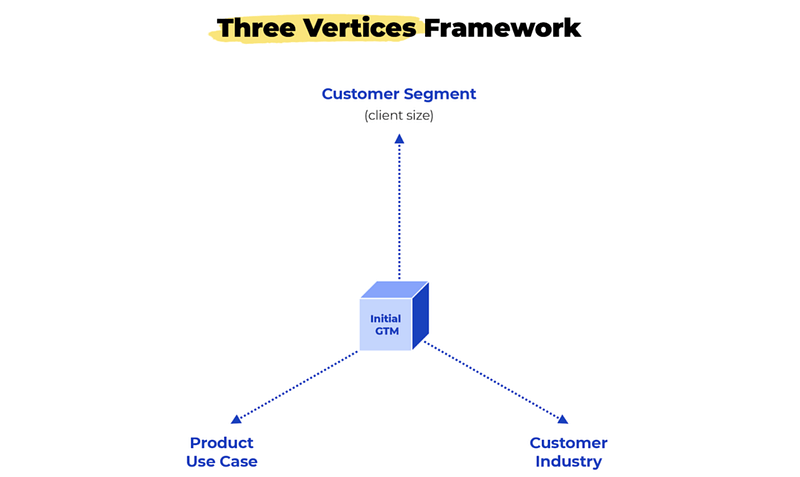

³Take a look at Esteban’s post to determine which cohort to focus on first.